I found this project by Andrea Brennen, which Rob highlighted here, incredibly refreshing. Considering the vital role money plays in Getting Stuff Built, discussion of financing and its repercussions is absurdly rare in critical discourse on architecture and urbanism. This is problematic – it’s not as if designs are hatched in a capital vacuum, funding schemes developed absent the design process, and the two magically mate at some point. There is sustained, substantial interplay between the two. Or, to appropriate a classic Lewis Tsuramaki Lewis appropriation, finance fucks with form*. Maybe it’s my own fault, and I’ve been negligent with what I have paid attention to; but the only firm or academic which springs to my mind as actively engaging with finance in any sort of a critical fashion is the cynically capitalist approach OMA has taken with some of their recent projects – for example, the tongue-in-cheek channeling of the extraordinary NYC market for views seen at their 23e 22nd Street project.

Capital flow is a critical component in the development of anthropogenic landscapes. The design of the mechanisms by which our tactical interventions (or unfortunate master plan extravaganzas) are funded has deep and profound implications, not just for the binary question of whether or not a project will happen, but upon all aspects of its design and realization. A truly post-modern urbanism (beyond master planned, formalist, big-bangist) – an incremental urbanism – will have to design, or at least explicitly consider, the financial machines integral to their tactics.

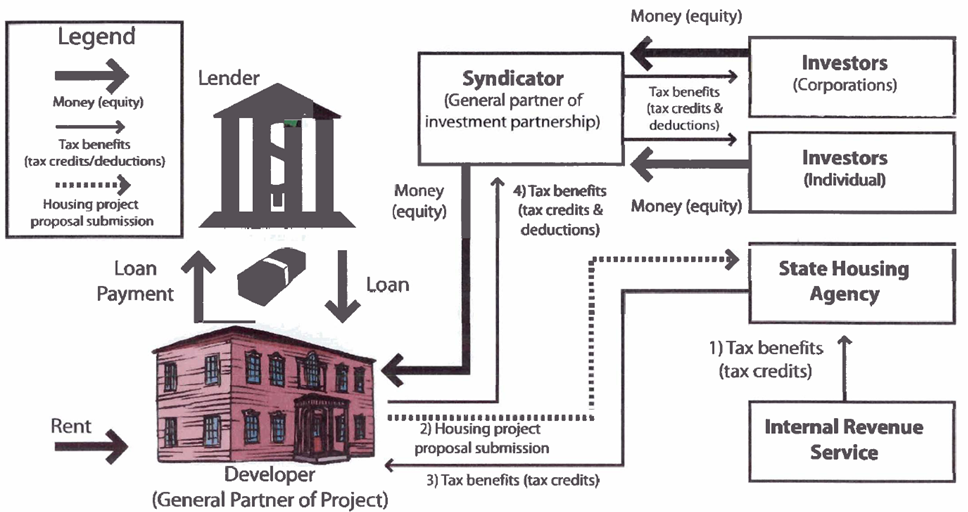

A banal but instructive case study of the Low Income Housing Tax Credit program demonstrates the type of complexity and design ramifications that funding processes can have. The LIHTC is the method by which capital is raised for low income housing projects across the country. In New York, it is one of the largest pools of funding available to finance affordable housing development. This program is based on Section 42 of the Internal Revenue Code, and was enacted in 1986 to provide the private market with incentives to invest in affordable rental housing.

These tax credits are awarded to developers after an application period which sees developers from across the state compete to earn funding for their affordable housing projects; and are in turn sold to private equity investors (financial institutions, private/public companies, funds of wealthy individuals) to raise equity to fund the construction of the building. In turn for the investment of up front equity, these private investors receive a tax credit equal to the total amount of tax credit allocated to the project. This amount is worth more than the initial equity investment, depending on the sale price of the tax credit. For example, if a $7 equity investment was used to purchase $10 in tax credit, the dollar for dollar price was $0.70. This spread is where the private investor makes money.

Additionally, the private investor is able to take the paper losses of the project during the first 15 years. This is deducted from their total taxable gain, further reducing their tax liability.

As recently as 2006, tax credits were being sold in the marketplace for as high as $1.02/$1.00. This high price reflected the additional value of the tax shelter and paper losses; it resulted in a yield of only 1.5-2%. At that time the largest purchasers of tax credits were Fannie Mae, Feddie Mac and Bank of America. As the recent turmoil and the financial market has caused these institutions to no longer have income in need of sheltering, a large portion of the demand side of the market has evaporated. Projects receiving funding allocations in the summer and fall of 2008 have been unable to find equity partners to purchase their credit.

In preparing their initial design submissions to the agency which oversees the funding process (DHCR) in February of 2008 many developers assumed price per dollar rates of $0.80 – $0.85/$1.00. Consequently as the market value of a dollar of credit fell below $0.75 and eventually became frozen, many projects became financially insolvent. To combat this issue, the economic stimulus bill included a provision titled the “Tax Credit Assistance Program” (TCAP) which would provide gap credit to make up the gap.

The program has been available for a short period of time, and to date no deals have closed which utilize its funding. The exiting of the marketplace by large institutions such as Frannie and Freddie, BofA and smaller players such as Keybanc and Raymond James has left an incredible vacuum in the marketplace, leaving many developers with credits unsalable at any price. Consequently, a large number of projects which had received funding, developed full construction documents and had contractors selected are stuck waiting for the market to thaw.

But these maneuverings affect more than just whether or not a project will be built – developers, engineers, and architects are constantly mindful of them throughout the design and construction of a project. Regardless of the market for tax credits, the financial terms have an affect on virtually every design consideration, on construction techniques, and on scheduling; as the terms set out by the government agencies distributing the funds and the private investors purchasing the credits are both complex and requisite components of any project which is to receive funding. HVAC systems, unit sizing and pricing, orientation, location, layout – everything is conceived within a financially sensitive framework. And although I have talked here about the public funding process for housing (primarily because this is where my expertise lies – much of my day job consists of doing energy and sustainability consulting on the aforementioned low income housing projects to help them meet the requirements of their various funding programs), it is absolutely true that market rate housing is similarly beholden to its own systems of finance; as the above OMA project and existence of firms like Corcoran Sunshine attests to.

Designers of affordable housing in upstate New York and those working on 23e 22nd Street at OMA are similar in their engagement with finance in that they are both taking a fundamentally reactionary position. That is, they accept the rules of the system in which their projects exist, and either acquiesce (affordable housing) or play games within its strictures, perhaps exposing the snafus (OMA). This is all well and good – at least they are dealing candidly with reality. But what I find so much more exhilarating about what Brennen is doing is the potential for architects and urbanists to take a proactive role in the financial realm.

What if built into proposals for our buildings and cities was an active mechanism by which they would be funded, such as in Brennen’s SuperNeutral proposal? We tried to deal with this question in our proposal for a Luandan fog farming infrastructure. While undoubtedly still an underdeveloped component of the project, we took care to sketch out not just the farming infrastructure itself, but also the funding and ownership scheme by which it be realized, and to understand it’s consequences for the design and potential affects of the system. This necessitated an understanding of the economics of the infrastructure and its products, and the local political realities. In fact, these were the primary drivers behind our realization that a fog farming infrastructure for Luanda would likely have to be split into an initial, government run and owned, centralized system; and a subsequent, rhizomatic network in the increasingly informal musseques which would hopefully benefit from the resultant economies of scale.

The non-profit lending organization Kiva, and others like it, are my favorite examples demonstrating how the design of financial mechanisms can transform urban environments. In locales where it has a presence, Kiva micro-finance loans may be the most successful tool for urban transformation, by providing the funding needed for local entrepreneurs to effect the sort of bottom-up, emergent urbanism so beloved by contemporary theorists. Ironically, this system which has proven so successful at engaging informal urban conditions and positively affecting them has almost nothing to do with traditional urban design or architecture, and is instead ‘merely’ a means of infusing capital into urban environments. It is incremental, targeted, and tactical; an instructive example for architects and urbanists as we seek to more accurately understand the evolution of our cities, and participate in their future.

Rob, thinking about all this has made me want to dust off and polish up some of our musings on vegetative homesteading… I bet we could even score a collaboration with Rod Dreher if we tried.

I think this is the problem though. For many architects developing this additional aspects goes beyond design and into politics, activism or… I do feel though that their is a “generation” is not the right word, of architects who do create the conditions for their own projects. Personally, i think the whole package is the best approach. For these economic, environmental and societal times especially.

Nam, good to hear from you again.

I’m a little unclear on what you’re saying… do you think architects getting involved in politics and activism via developing a “whole package” is a problematic trend?

I didn’t mean to make an argument for architectural activism here (not that it is one I wouldn’t make); I was more interested in talking about the effect of finance on the development and execution of architecture. Though the examples of proactive financing I used could probably be accurately described as ‘activist’ architecture.

BTW, I’m looking forward to reading that essay you posted a while back on cities, image, and symbolism by Regina Bittner. Nice find.

becker,

No. I don’t think it is problematic. In fact it seems the logical direction if one wants to expand the “field” of architectural possibilities. i particularly like your suggestion of linkages between models of “proactive financing” and “activist architecture”.

I do feel as if there is hesitation (less so amongst a certain cohort of architects) to address such issues though. For example I remember a friend of mine finishing his MArch related how a professor asked (with a somewhat disparaging tone) do you want to be an architect or activist…Specifically because he was going beyond a simple image/object, fictional “thesis”.

Personally, i feel like it makes business sense, in general but especially in such difficult economic times. Plus, i think it gives a wider field to play on, allowing a architect to address issues of interest to them that might not be as easily addressed by traditional methods of funding.

I think also that “desiging” the funding mechanisms etc for a project as you all did in your Luanda project) also increases chances of actual implementation. Partially the divide seeming to be thus, between “architectural fiction” (competitions etc) and built work…

I found that Bittner piece interesting. Mainly because I feel it ties in nicely with recent (or not so recent) critiques of Staritecture and architectural tourism..

Stephen, totally agree about the desire to dust off the vegetative homesteading project. Need to push that one forward.

[…] for Volume) comments on the “Office for Unsolicited Architecture” from Volume 14, which Stephen and I have both tangentially touched on in the past: [T]he role of reality in the production of an […]

Super interesting discussion, sorry, I realise I’m a little late to the party. This engagement with finance as a design driver seems to form part of a movement to expand the scope of the discipline to deal with the broader context (political, social, economic, environmental, etc.). Actually it feels less like a ‘movement’ and more of an *imperative* – the grand old days of merely designing what it looks like and what its made of are long gone. We are firmly a part of economic and political power plays, and the sooner we come to understand this, acknowledge it, and learn to navigate it (instead of playing the naive and independent stylist) the better.

The complexity of your explanation of LIHTC got me a bit worried though, do we need to become economists or quantity surveyors as well? Thinking whether there’s a difference between architects exploring alternative models of financing a project ‘in principle’ (as in the OMA example above, and Andrea’s SuperNeutral project) and architects ‘actually doing’ the finance? I guess we just need to know enough in order to subvert it, like planning regs.

And cheers for picking up my post on unsolicited, I think there’s a lot in this.

Rory –

Thanks for your thoughts, and the great examples written about on your blog. I hadn’t previously heard of any of them.

About the LIHTC: even without ‘actually doing’ the finance, architects are still forced to operate within the constraints of that process – whether or not we choose to engage it. The question becomes, what is the nature of our engagement? You identify subversion as one potential way forward, but I don’t think it’s the only one: as demonstrated by SuperNeutral and Kiva, financial mechanisms (when properly designed) can actually effect work which is quite good, no subversion necessary. I think what’s important for designers to remember (learn?) is that, similarly to buildings and landscapes and infrastructures, financial structures themselves are also a product of design. Sometimes, we’ll have to accept that design, and maneuver around it; sometimes we’ll be able to shape it ourselves. Regardless of the approach taken, we need to understand it, no matter how worryingly complex it may be.

I should also note that I couldn’t agree more with your assertion that marketing, politics, etc are equally realms in which we need to become more fluent (as the PLOT project demonstrates). I’m looking forward to talking about this more.

Hi Stephen –

I like this idea of the ‘nature of our engagement’ with finance (or whatever other body of knowledge that’s ‘traditionally’ outside of architecture), there’s definitely a sliding scale from the ‘whole package’ approach Nam describes to the more blunt acceptance of given conditions.

To zoom out even further, are we just talking about ‘context’? To understand the context in architecture normally means literally to understand the site context – the two terms are used interchangeably – but as all of these other factors are now just as unavoidable as the site, they therefore warrant their own techniques (even personal styles) for dealing with them. Of which, as you say, subversion might just be one (perhaps more cynical or ‘activist’) approach. So yeah, what you said!

And if you hear of any other ‘unsolicited’, ‘creatively financed’ or ‘politically probing’ projects, please send them my way. I’m in discussions to hopefully put together something exciting… More soon.

[…] a recent back and forth between myself and Rory Hyde in the comments of On Finance, Rory noted: To zoom out even further, are we just talking about ‘context’? To understand the […]

[…] has written frequently about the city as it is constructed by complex interactions between systems, economies and societies, and argued that architects should engage this context. If one accepts […]